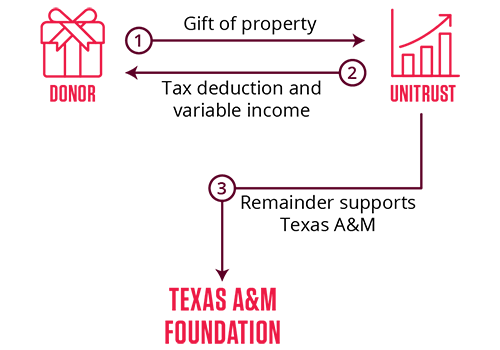

Charitable Remainder Unitrust

A charitable remainder unitrust allows individuals to turn an appreciated asset that generates little or no income into a productive asset without paying capital gains taxes on the sale. Through a charitable reminder unitrust, which can be funded with appreciated securities, real estate or cash, you can make payments to selected beneficiaries for their lifetimes or for a specified term of years. At the termination of the trust, the remaining assets are distributed into an endowment that benefits Texas A&M as you wish.

Advantages:

- Receive an immediate charitable income tax deduction.

- Reduces capital gains taxes on appreciated securities or real estate used to fund the gift.

- Receive payments from the trust based on a set payout rate.

- Relief from the maintenance, tax and insurance obligations on real estate used to fund the trust.

Download our estate planning kit